Board statement

On the 1st of October 2024, the Virgin Money UK PLC group (VMUK) became part of the Nationwide Building Society (NBS). This VMUK published Tax Strategy is in alignment with the NBS Tax Strategy.

The VMUK Group of companies (the Group) has a low appetite for tax risk. It pays all taxes due, including substantial VAT and employer’s liabilities, and does not use complex structures or offshore havens to minimize those liabilities.

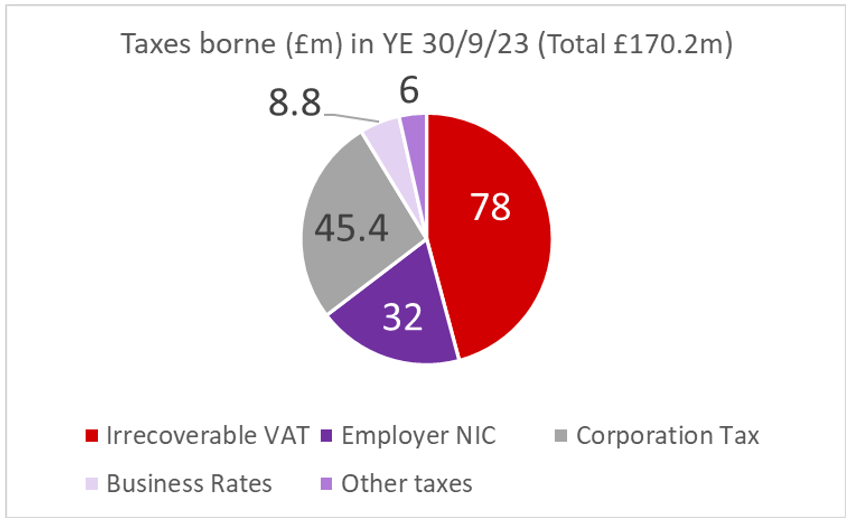

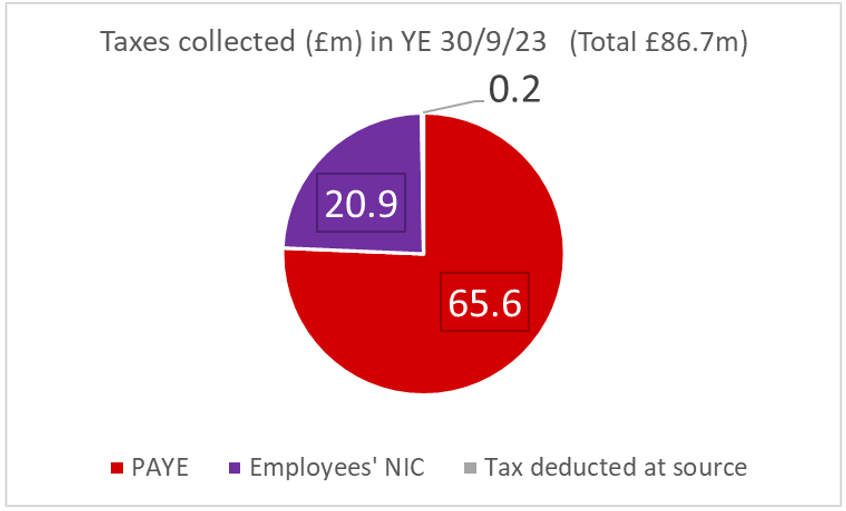

The charts below illustrate the Group’s contribution to HM Government cash tax revenue in its financial year most recently published, namely the year to 30 September 2023.

The Group’s tax strategy sets out the Board-defined objectives with respect to Tax, having regard to the organisation’s risk appetite and, in conjunction with the tax policy standard, defines accountabilities of the business in relation to tax.

In particular, the Group will:

- Comply with all relevant laws and disclosure obligations;

- Deal transparently, professionally and appropriately with all tax authorities;

- Only undertake tax planning in the context of wider business activities having a commercial, economic basis;

- Maintain accounting systems and controls sufficient to support tax compliance obligations;

and will not:

- Enter into arrangements where the whole or main benefit is the avoidance of tax; or

- Be a party to tax evasion.

The Senior Accounting Officer (a role held by the Chief Financial Officer (CFO)) undertakes an annual review to allow confirmation to HMRC that the Group has in place appropriate tax accounting arrangements to allow its tax liabilities to be calculated correctly. During 2023, HMRC rated the Group as a “low risk” taxpayer.

The VMUK Group tax strategy is adopted by Lanark Holdings Ltd and its subsidiary companies.

Strategic tax objectives

- To maximize long term shareholder value in relation to the tax impacts of the Group’s business activities, at a level of risk consistent with all applicable rules, the Group’s reputation, and the Code of Practice on Taxation for Banks.

- To provide robust and transparent tax disclosures for financial reporting.

- To anticipate, manage and communicate material tax risks, whether resulting from changes in tax legislation, the economic environment in which the Group operates or other intrinsic factors.

Approach to Tax Risk Management and Governance

The strategic objectives will be met through application of the Group’s Tax Policy which defines the Group’s tax risks and sets out minimum controls to mitigate them.

The Tax Policy Standard is part of the Board- approved framework of policies, approved at least every three years. Policy ownership ultimately rests with the Board.

The Head of Tax reports, via the Financial Controller, to the CFO, a member of the Bank’s executive Leadership Team and Board of Directors, thereby ensuring appropriate Board accountability and oversight of all tax matters. Any relevant breaches of policy would be escalated to the CFO.

More details on the Group’s governance arrangements are given in the Annual Report and Accounts, available at www.virginmoneyukplc.com Link opens in a new window.

Attitude towards Tax Planning

VMUK is a signatory to the Code of Practice on Taxation for Banks. HMRC has confirmed that, in its opinion, the Group is meeting all its obligations under this Code. The Group will only undertake tax planning in the context of wider business activities having a commercial, economic basis. We do not promote avoidance or aggressive tax planning arrangements to customers or third parties, and where we offer tax-advantaged products, such as ISA savings products and pensions, it is only where the tax consequences of these products are both clear and consistent with the intentions of Parliament.

The Group has an in-house tax department, staffed by qualified, experienced tax professionals, which undertakes most tax activities. However, we recognise that tax is an increasingly complex area, and it may, on occasion, be appropriate to seek external views. Tax planning or structuring advice may be sought in the context of complex transactions, principally to provide challenge to technical interpretation and ensure compliance with relevant statute and to ensure that business decisions are undertaken in the full knowledge of current and likely interpretations of legislation and guidance.

Level of Risk

The Group has a low appetite for tax risk. It does not participate in aggressive planning or complex, structured arrangements designed to minimize its tax liabilities. Further, the Group operates only within the UK. During 2023, HMRC rated the Group as a “low risk” taxpayer.

Approach towards dealings with HMRC

The Group deals transparently, professionally, and appropriately with all tax authorities, including its lead regulator, HMRC. Regular dialogue ensures progress on open matters; there are no material historic matters outstanding.

The Group proactively raises potentially contentious matters with HMRC. Where relevant, tax clearances are sought to provide certainty where there is more than one possible interpretation of the law, and the matter is material by nature or by size.

The Group contributes constructively to relevant public tax consultations - both on its own and through industry bodies - with a view to ensuring legislation is ultimately fit for purpose and that the intentions of Parliament can be given effect in a practical way.

Compliance with legislation

This statement has been prepared in accordance with the requirements of Schedule 19, Finance Act 2016, paragraph 16. The Group regards this publication as complying with its duties under paragraph 16(2) in its current 2024 financial year.